Everything about Medicare Faq

Table of ContentsFacts About Medicare Faq RevealedThe Facts About Medicare Parts UncoveredGetting The What Is Medicare To WorkOur Medicare Faq StatementsThe Basic Principles Of Medicare Faq

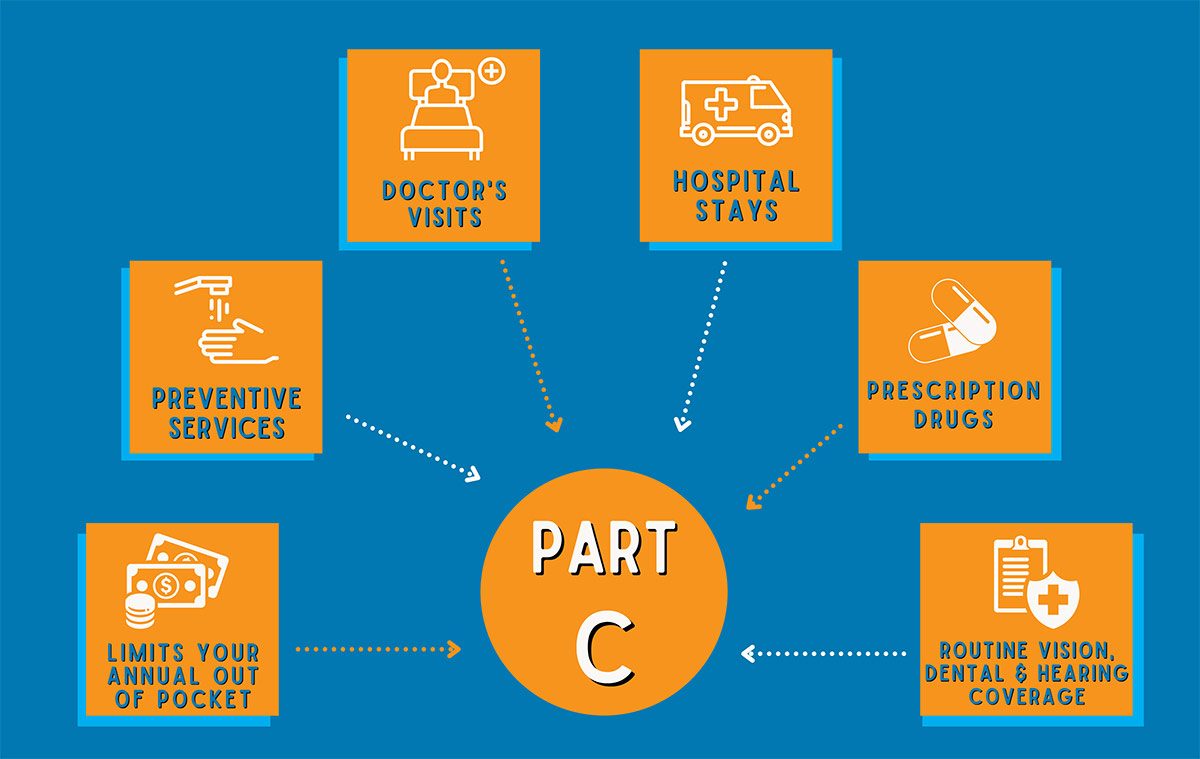

Outpatient care. Preventative services. Long lasting clinical equipment., you may pick to postpone enrollment until you retire or leave work. However, if you of transforming age 65, you must request Part B to begin when you transform age 65. Federal regulations might not allow state-registered cohabitants to delay signing up in Part B without a charge.Medicare Component C Medicare Advantage Medicare Part C, likewise recognized as Medicare Benefit prepares, generally includes Components A, B, and D. Some Medicare Benefit plans include additional benefits.

, you do not need to register in Medicare Benefit. Medicare Component D Prescription Medication Insurance Coverage Medicare Part D assists cover the price of prescription medicines. It is a voluntary program readily available to people signed up in Medicare Component An and also Part B. you need to recognize: You do not need Medicare Component D with SEBB medical plans.

The SEBB Program does not supply stand-alone Medicare Component D plans. A Medicare supplement strategy, or Medigap plan, can aid pay for some of the health and wellness care expenses that Medicare Part An as well as B don't cover, such as copayments, coinsurance, as well as deductibles.

Facts About What Is Medicare Revealed

You do not need Medicare Part D with SEBB clinical plans. SEBB medical plans consist of prescription drug protection that is as great as or much better than Medicare Part D. If you or your reliant enrolls in a stand-alone Part D strategy, your SEBB clinical plan might not coordinate prescription drug benefits keeping that strategy.

Yes, unless you have UMP High Deductible. Workers and also dependents coming to be eligible for Medicare can pick to maintain SEBB medical as main coverage, with Medicare protection as secondary, if they enroll in Medicare. Enrolling in Medicare develops a special open enrollment that permits you to change clinical strategies.

If you retire and are qualified for PEBB retiree insurance protection, you and your protected dependents should register and remain signed up in Medicare Part An and also Component B, if eligible, to enlist in or keep a PEBB retiree health insurance plan. Medicare will end up being main protection, and also PEBB clinical comes to be second insurance coverage.

Medicare covers inpatient health center treatment and also some of the medical professionals' fees click over here now and other clinical things for people with Alzheimer's or mental deterioration that are age 65 or older. Medicare Part D Covers numerous prescription drugs. Medicare will pay for up to next page 100 days of knowledgeable assisted living facility care under limited scenarios.

Unknown Facts About What Is Medicare

Medicare will certainly spend for hospice care provided in the home, a nursing care neighborhood or an inpatient hospice establishing for people with dementia that are established by a physician to be near the end of life. See Medicare's website for even more details, consisting of: Where Medicare Component A covers healthcare facility and skilled nursing treatment, Medicare Component B assists spend for services from physicians and other health care suppliers, outpatient care, home healthcare, sturdy clinical equipment and also some precautionary services.

Just Medicare recipients with mental deterioration can enroll in these strategies. Find out more information about Medicare SNPs. To discover the Medicare SNPs in your area: Use the on the internet Medicare Plan Finder at medicare. gov or call Medicare at 800. 633.4227. Medicare. gov provides details concerning Medicare, open enrollment, advantages as well as exactly how to find Medicare plans, facilities or service providers.

Medicaid.

Individuals a minimum of 65 years of age that are U.S. residents or irreversible homeowners are qualified for Medicare. The majority of individuals eligible for Social Security are likewise eligible for Medicare. Individuals that are more youthful than 65 with certain impairments additionally qualify, along with those that get on dialysis or have had a kidney transplant.

Not known Incorrect Statements About What Is Medicare

With Medicare Benefit prepares, you might see changes in the doctors and also health centers included in their networks from year to year, so call your suppliers to ask whether they will stay in the network next year. There may likewise be changes to the plan's vision and also dental coverage, as well as the prescription medicines it covers, states Danielle Roberts, a founder of Boomer Perks, a Medicare insurance broker.

Analyze your benefits declarations as well as medical expenses for the past year, after that include up what you paid in deductibles and copays to get the true expenses of your plan. After that consider what you may pay the list below year, if you need, state, a knee replacement or have an accident.

Consider the effects of switching. When you initially enlist in Medicare at age 65, you have actually a guaranteed right to acquire a Medigap plan. And also insurance firms are required to renew coverage yearly as long as you remain to pay your premiums. Yet if you shop a Medigap plan afterwards registration home window, insurance providers in numerous states may be able to turn you down or bill you extra as a result of a preexisting problem, Roberts states.

Some Known Facts About Medicare Parts.